Rio Tinto plays 'godfather' in Aotearoa-New Zealand

Published by MAC on 2012-09-18Source: Hot Topic

"No industry in New Zealand uses more electricity than New Zealand Aluminium Smelters/Rio Tinto Alcan NZ".

That's according to Simon Johnson, writing last week on the climate change blog, Hot Topic.

Says Johnson: "No industry pays less per unit for electricity than they do. They even get excessively allocated emissions units to help with the lowest priced power contract in New Zealand. And now New Zealand Aluminium Smelters/Rio Tinto Alcan NZ are going for 'Godfather' gold by trying to bully their power price even lower."

This isn't a new scandal by any means. In fact, it's arguably the oldest of its kind in the country. See: Rio Tinto gets no Medals from its critics

Rio Tinto Alcan NZ plays godfather: nice aluminium smelter you got, be a shame if something happened to it...

Simon Johnson

Hot Topic (New Zealand)

11 September 2012

Simon Johnson argues that Rio Tinto Alcan NZ (NZ Aluminium Smelters Ltd), the owner of the Tiwai Point aluminium smelter is "Godfathering" the smelter, its workforce, the Southland economy, the NZ electricity market, Meridian Energy and the poor critically endangered slow-breeding kakapo, as well as "Godfathering" the NZ emissions trading scheme to get excessive free allocations of emissions units.

Let me introduce a new term to climate change blogging. Godfathering. It's a bit like Grandfathering, which is a recognised jargon term from emissions trading. But different. Grandfathering in an emissions trading scheme (an ETS), is giving the emission units for free to the existing emitters in the ETS on a historic pro-rata calculation. The number of units given represents the desired cap on emissions.[1]

Of course, our ETS is not so simple. If our ETS just applied simple "grandfathering" as outlined, then it would have a real cap, it would not allow importing of unlimited international units, and it would be impossible for any emitter to receive more units than their emissions.

That's not the case under the NZETS, at least for some emitters. In 2010, NZ Aluminium Smelters Ltd, which is roughly New Zealand's third largest point source of greenhouse gas emissions, was a net seller of units, not a net payer. Their free allocation of units was 135% more than the units they needed to surrender for their emissions.

The justification given for this is that in order to maintain their export competitiveness, NZ Aluminium Smelters Ltd needed to be compensated for the rather unfathomable and diluted ETS costs that may flow through their secret contract with Meridian and the electricity wholesale market. I will come back to this later in the post.

Let me update their emissions and allocations for the 2011 year. In 2011, NZ Aluminium Smelter Limited produced 354,030 saleable tonnes of aluminium. The 2011 Ministry of Economic Development Chief Executive's Report shows that the New Zealand aluminium manufacturing sector (a.k.a. NZ Aluminium Smelter Ltd) reported emissions of 601,370 tonnes CO2-e for the 2011 year. We divide by two for the ‘two tonnes for one unit' deal, and that results in 300,685 units to surrender.

The Ministry for the Environment allocated 437,681 units to NZ Aluminium Smelter Ltd for the 2011 calendar year. That's 136,996 more units allocated than surrendered or alternatively the units allocated to NZ Aluminium Smelter Ltd exceeded the units surrendered by 146%. So that's even more excessive than 2010′s 135% over-allocation!

How did NZ Aluminium Smelter Ltd/Rio Tinto Alcan NZ Ltd achieve that? Simple really. They threatened to close the smelter and move production offshore if the NZETS really imposed a real carbon price on them.

Thats a nice aluminium smelter you got. Be a shame if something happened to it.

Now thats what I call "Godfathering"! But wait there is more.

In July, Rio Tinto Alcan NZ announced an annual loss. CEO Ryan Cavanagh said the smelter's financial difficulties were due to falling world aluminium prices. And that they needed to revise their electricity supply contract with Meridian Energy to get input costs down. A day later, the parent company Rio Tinto Alcan indicated what may happen to it's unprofitable smelters. They will be shut down. No pressure, Meridian Energy!

Thats a nice aluminium smelter you got. Be a shame if something happened to it.

According to Brian Fallow, if the smelter closes, there could be a "seismic" knock-on effect on the electricity market. Supply would exceed demand by the 14% of NZ's electricity generation used by the smelter. Wholesale electricity prices would react. Some generation assets might be crowded out.

Thats a nice wholesale electricity market you got. Be a shame if something happened to it.

Brian Fallow notes the Meridian power contract, that the smelter wishes to renegotiate, represents 40% of Meridian's sales. Closure of the smelter or renegotiation of the contract put the spanner of uncertainty into the Government's planned partial sale of Meridian and the other generators.

Nice plan for partial privatising some state-owned power generators you got. Shame if something happened to it.

The closure of the smelter would also have an impact on the local Invercargill and Southland regional economy.

Nice regional economy you got. Shame if something happened to it.

Next we hear that the smelter is fast-tracking the redundancies of it's highly-trained and highly-paid workforce.

Nice well-trained professional smelter labour force you got. Shame if something happened to it.

And Rio Tinto Alcan NZ also wants to withdraw from partly funding the successful Kakapo Recovery Programme.

Nice charismatic endangered species programme you got. Shame if something happened to it.

That's a lot of Godfathering!

Let's look at New Zealand Aluminium Smelters' electricity use and costs in 2011. How much do they use? How much do they pay? Does their power cost justify extra allocations of emissions units? Is it realistic for New Zealand Aluminium Smelters to try to get Meridian to give them cheaper power?

Let us look at some electricity use data from the Energy Data File 2012. The actual data is Spreadsheet G worksheet G.6.a. now at Google Docs.

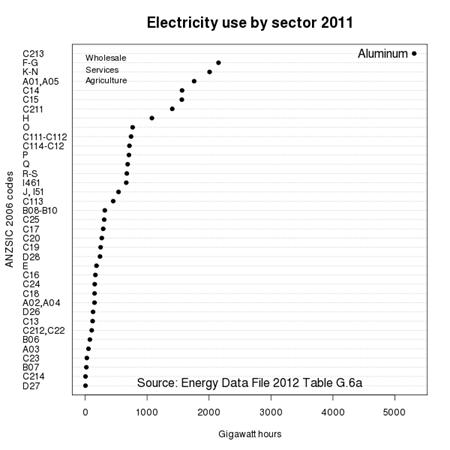

This dotchart is of electricity use data in 2011 by industrial sector from Spreadsheet G worksheet G.6.a..

The chart makes it very clear that the Tiwai Point Smelter is, by a huge margin, the biggest single consumer of electricity in New Zealand. A single company at a single plant used 5.3 million MWh out of 38.8 million MWh consumed in 2011, or 13.67% of the total consumption. Only the combined 4.4 million people in homes (the residential sector) used more, with 13 million MWh or 33% of the total. If we just look at industrial use of electricity, and leave out the residential sector, the smelter uses 20.6% of all electricity used by industry.

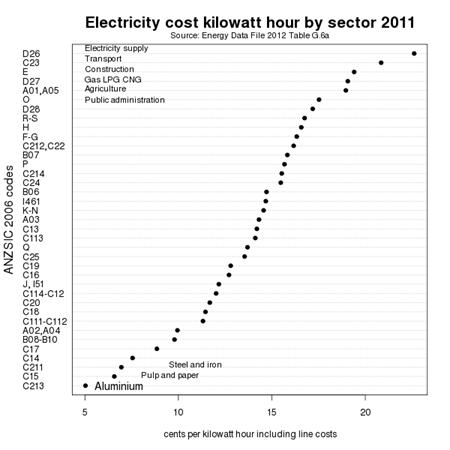

This chart shows industrial electricity sectors sorted by average rate (including line costs) in cents per kilowatt hour (i.e. its MWh divided by sales $ times 100). You need to look at the bottom left hand corner, not the top. That's because Rio Tinto Alcan NZ Ltd/NZ Aluminium Smelter Ltd pays the very lowest average rate for electricity in New Zealand; 5.03 cents! Residential users pay 22.6 cents per KWh, or four times as much.

No industry in New Zealand uses more electricity than New Zealand Aluminium Smelters/Rio Tinto Alcan NZ. No industry pays less per unit for electricity than they do. They even get excessively allocated emissions units to help with the lowest priced power contract in New Zealand. And now New Zealand Aluminium Smelters/Rio Tinto Alcan NZ are going for "Godfather" gold by trying to bully their power price even lower.

--

Notes

1. Alternatively the units could be sold by auction to emitters which is logical if we treat the units as shares in a public commons owned by the Government on behalf of citizens.